When it comes to choosing between brands, customers can seem like they are going down the rabbit hole. With so many choices available on store shelves, how do shoppers decide which product to buy? The answer lies in understanding digital behavior tracking among consumers.

In the last few years, Luth Research has seen an abundance of requests from clients that want to truly understand their customer journey online AND in-store. These clients are no longer only the ones that you would expect to sell products online. Consumers are now buying almost everything online including toothpaste and mouthwash - products that were typically only bought in-store just a few years ago.

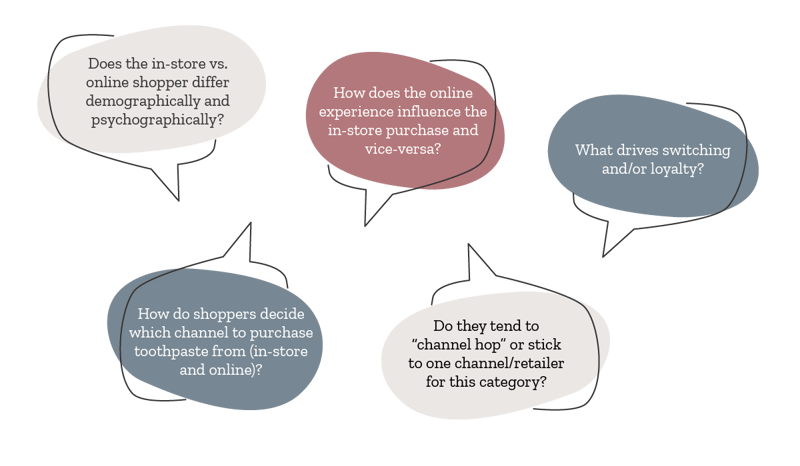

This shift has prompted companies to gather a new type of shopper insight data. With lines blurred between in-store and online shopping, it is critical to understand touchpoints for both journeys to be able to optimize presence wherever the shopper engages. Using toothpaste as an example, it is important to understand how the decision to shop in-store vs. online is made:

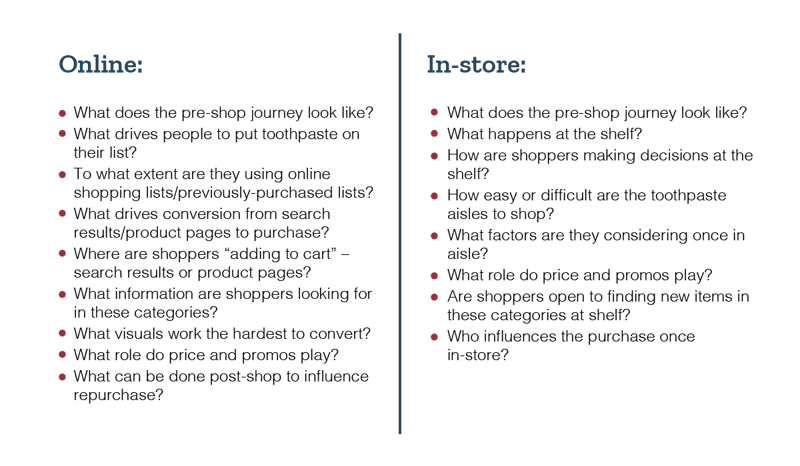

After answering these questions, you can delve into the differences between online and in-store to answer the following:

Recommended Methodology

Once you've identified the key questions that need answers, it's time to choose a methodology that is well suited to help you track consumer behavior. For the type of shopper insight data in our example of shopping for toothpaste, we recommend a three-stage exploration of consumer behaviors:

-

Analyze Historical Digital Data:

Dive into past digital data to understand how behavior has changed over time and what might be influencing these changes. Leveraging Luth’s panel of consumers who have agreed to have all of their online activity monitored, we can tap into historical digital data for granular and actionable insights. We can identify people who have shopped the category on key retailer sites for the last 6 months or any time frame agreed upon. We then analyze pre, during and post online shopping, how they leverage search, as well as their navigation patterns such as visits, conversion, time pattern analysis and product/brand/search term popularity.

-

Run Channel Surveys (Online vs In-store) to quantify touchpoints, determine influences and capture attitudes and preferences:

Online shopper survey can be completed with consumers who will be shopping the category within a specific time period (one week, one month, etc.). This survey is designed to capture their path to purchase process including pre-shop preparation, on-site navigation, their selection/deselection process, and the purchase decision. This survey is programmed to deploy directly after their online shopping trip.

In-Store shopper survey is designed to capture a consumer’s path to purchase process including preshop preparation, in-aisle navigation, their selection/deselection process and the purchase decision at the point of purchase. Prompts can be given to take pictures during the survey process of the actual shelf and what was a positive influence to purchase and what was not. -

Conduct Qualitative In-Depth Interviews to provide a deep dive into how shoppers behave:

One-to-one interviews with a smaller portion of the consumers are an effective way to further understand the shopping journey. Select panelists from the survey portion above to participate in an in-depth interview online using Zoom with a professional moderator. Leveraging survey responses, the in-depth interviews will further explore the path to purchase journey to offer context to shopper attitudes and behaviors as well as shopper voice to bring the journey to life

Conclusion

Understanding the shopper journey (and how it's changing) from pre-shop to in-store to post-shop for both the in-store journey and the online journey as well as the blurred lines in between takes rich shopper insight data that most don’t have at their fingertips. By understanding the consumer’s non-linear customer journey through digital behavior data, brands can make informed decisions on eCommerce strategy, optimize customer experience (both online and in-store), and round out marketing recommendations.